SASB Standards overview

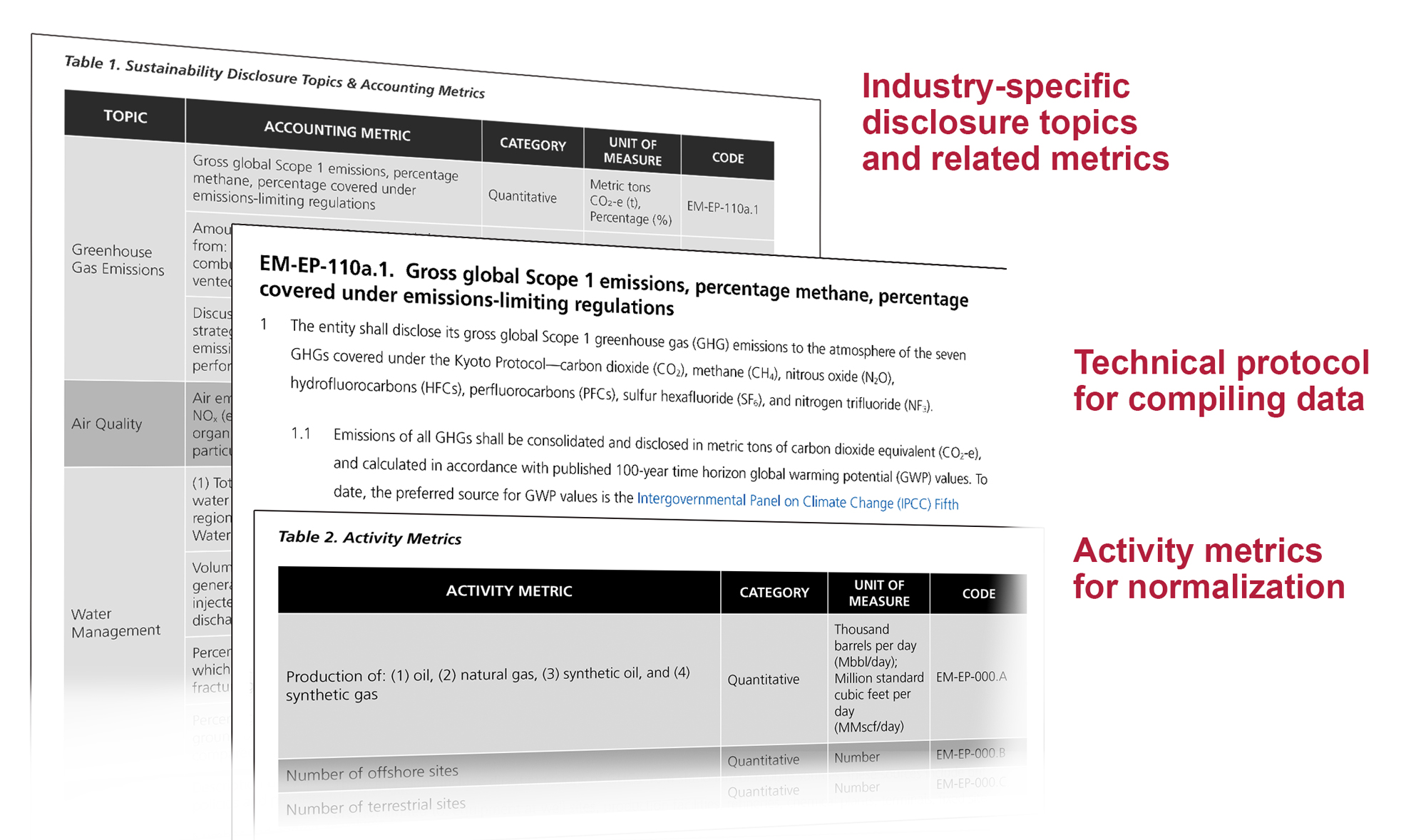

SASB Standards enable organisations to provide industry-based disclosures about sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, access to finance or cost of capital over the short, medium or long term.

SASB Standards identify the sustainability-related issues most relevant to investor decision-making in 77 industries. The Standards were developed using a rigorous and transparent standard-setting process that included:

- evidence-based research;

- broad and balanced participation from companies, investors and subject-matter experts; and

- oversight and approval from the independent SASB Standards Board.

Global investors recognise SASB Standards as essential requirements for companies seeking to make consistent and comparable sustainability disclosures.

As of August 2022, the International Sustainability Standards Board (ISSB) of the IFRS Foundation assumed responsibility for the SASB Standards. The ISSB has committed to maintain, enhance and evolve the SASB Standards and encourages preparers and investors to continue to use the SASB Standards.

The SASB Standards play an important role in the first two IFRS Sustainability Disclosure Standards, IFRS S1 General Requirements for Sustainability-related Disclosures and IFRS S2 Climate-related Disclosures. Learn more about how the SASB Standards support the application of IFRS Sustainability Disclosure Standards.