Mikkel Skougaard, Group ESG Reporting Senior Expert, MOL Group

The following guest blog was written by Mikkel Skougaard, who is Group ESG Reporting Senior Expert at MOL Group. He recently shared these and other insights in SASB 201: Getting Prepared: Materiality, Gap Analysis & Benchmarking, the second session in SASB’s four-part Implementation Webinar Series.

Until 2019, MOL Group did what many companies do: We published a comprehensive sustainability report, which grew over the years to meet increasing demands for environmental, social, and governance (ESG) data and insights from all angles. However, in our eagerness to meet every need, we felt we had lost our sense of direction by continually adding pages to our sustainability report. So, we asked ourselves whether we were serving our ultimate client—the capital markets—with the best possible product. Did we really provide investors with decision-useful ESG information as they increasingly prioritized—and often struggled with—ESG integration?

We see two parallel trends which we think are working against each other. On the one hand, analysts and investors are taking progressively more sophisticated approaches to how they integrate ESG considerations, including a welcome aptitude for differentiating between signal and noise—i.e., material and non-material ESG factors. On the other hand, sustainability reporting practices are often disconnected from capital markets, resulting in long reports with seemingly endless pages of narrative, colorful charts, pictures, infographics, anecdotal stories, and commitments—but without necessarily meeting the needs of the ultimate “client”: investors and analysts.

Capital markets are beyond the point of recognising the importance of financially material ESG risks and opportunities. What they need now is a standardised and codified way to understand these factors. Instead of spending all their time evaluating different measures of ESG risk, capital markets should be focused on assessing, managing, and mitigating the risk itself. With this in mind, MOL decided to break with tradition, chart a new path, and reconnect with capital markets. SASB standards helped us facilitate this shift.

Sharpening Our Focus

Producing a longer sustainability report each year—a format that few capital market participants read, anyway—had begun to feel like a race to the bottom. So, we reduced the sustainability section inside our integrated annual report from 70 to 10 pages, focusing only on the ESG data and narrative that would be material to our investors. Meanwhile, we integrated our other ESG data—which is important to other stakeholders—into our group-wide Data Library, an Excel sheet containing financial and operational data, and (as of 2019) all our ESG data (more than 100 indicators and 650+ data points).

Now, our sustainability reporting consists of one page with a set of core, material ESG metrics that relate to long-term performance or risk, with a subsequent nine pages that explain changes to those core KPIs as well as significant changes in performance affecting MOL Group’s sustainability risk profile. In our journey of re-connecting with the capital markets by focusing our efforts on material information only, we introduced SASB standards into the sustainability report. SASB standards were the right fit for at least two reasons: 1) The standards are widely recognised and supported by global investors, and 2) because of their focus on financial materiality, SASB standards allowed us to test our own materiality assumptions. In this way, SASB standards provided a needed “link” back into our capital markets-focused reporting, helping us supply providers of capital with financially material, decision useful, and industry specific ESG information.

MOL’s Implementation Journey

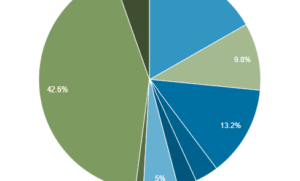

So how did we go about it? First, we chose our industries. For a “pure-play” company in the Oil & Gas – Exploration & Production industry, it would be a simple choice. However, for an integrated oil and gas firm with several business lines—like MOL Group—it is more of a challenge. Once we went through and selected our industries (eight in all), we conducted a gap analysis for each, comparing our existing reporting to the SASB standard and splitting our findings into three categories: fully, partly, and not disclosed. With our gap analysis spanning eight SASB industries, it ended up looking a bit like a patchwork, which was frustrating. However, the exercise helped us realise that you do not necessarily need to disclose everything at once. For example, some indicators may be material for one business line, and while they would need to be disclosed if that business was a stand-alone unit, they may not be material at a group level.

This understanding helped us move forward, putting our analysis into practice. Since we have been reporting ESG information for 20 years, our work involved fitting SASB standards into an existing internal reporting framework (for data collection and validation), years of external reporting, and a pre-existing materiality matrix (which turned out to be closely aligned with SASB’s own evidence-based materiality assessment). As a result, when disclosing a specific core ESG indicator, we were able to cross-reference it to a pre-existing SASB code.

Every Company is Unique

However, your implementation pathway will depend on where you are on the ESG disclosure adoption curve. One thing we have learned is that there is no one-size-fits-all approach to ESG reporting. Rather, there are many paths. For MOL Group, we are taking a gradual implementation approach to SASB standards, with the final aim of having complete alignment between financial and non-financial reporting at both the group and divisional levels.

Nobody is expected go from zero to hero overnight, but the market needs companies to re-focus their sustainability reporting—getting back to decision useful information—in order to crack the code of ESG integration. For MOL Group, SASB standards proved to be the missing link in helping capital markets understand the ESG risks and opportunities we face as we build resilience into our business model and adapt to a carbon-constrained economy.