Drug-resistant disease could cost global economy up to $100 trillion.

Approximately 70 percent of medically important antibiotics in the United States are sold for use in food-producing animals. This shocking statistic, coupled with the spread of antibiotic resistant bacteria has created growing concern among consumers, regulators, and investors regarding antibiotics in animal agriculture. Companies, to differing degrees, have recognised this tide change and are adapting production practices to address these concerns.

Consumer Concerns

A 2012 Consumer Reports Survey found that 72 percent of consumers were concerned about the use of antibiotics in animal agriculture. Crucially, when it comes to antibiotics, consumers are putting their money where their mouth is. Between 2009 and 2014 sales of fresh chicken raised without antibiotics more than doubled from nearly $500 million to over $1 billion.

This movement of consumers away from antibiotic use in food-animal production hasn’t been lost on companies. During its 2017 presentation to the Consumer Analyst Group of New York, Tyson Foods noted “to meet growing demand…the entire Tyson brand at retail will be chicken raised with no antibiotics ever.” Coming from the largest chicken producer in the United States, the implications of this are impossible to overstate.

Regulatory Scrutiny

While consumers are widely concerned with the use of antibiotics in animal production writ large, regulators are specifically concerned with the use of antibiotics that are medically important to humans. In the United States and Europe this has led to a variety of approaches to curb the use of medically important antibiotics. In the United States, the FDA has released guidance for voluntary practices to phase out the use of medically important antibiotics in food animals. Europe has gone a step further. In addition to banning antibiotics used in human medicine, the EU has banned the use of antibiotics in animal growth promotion.

Investor Pressure

Following the growing consumer concerns and increasing regulatory scrutiny, investors are beginning to apply pressure on companies to develop and enact policies supporting the prudent use of antibiotics in food-animal supply chains. A coalition of investors, with $2 trillion in assets under management, have been encouraging companies to reduce their “excessive” use of antibiotics. Giving credence to the importance of this issue for investors, the Farm Animal Investment Risk & Return Initiative points to research by the U.K. government that found drug-resistant disease could cost the global economy up to $100 trillion in lost production.

From Resistance to Acceptance

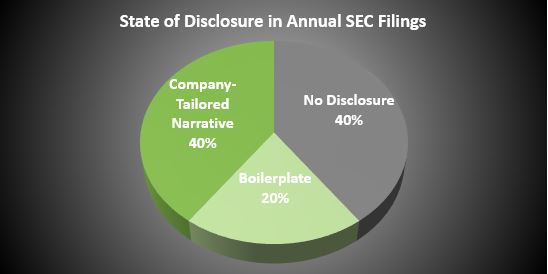

Companies along the food and beverage supply chain have been quick in responding to pressure from consumers, regulators, and investors. Through policies that support and enforce the judicious use of antibiotics in production and sourcing practices, companies are working to mitigate the impacts of antibiotic resistance. Despite this effort, current communications, particularly with investors, provide little insight on performance, as Figure 1 shows.

Figure 1: Disclosure on Animal Welfare in the Meat, Poultry & Dairy Industry

Source: SASB analysis performed between May and August 2016 using the latest annual SEC Filings (i.e. Form 10-Ks and 20-Fs) for the top companies, by revenue, per SICS industry (10 companies).

With current industry disclosure lacking decision-useful metrics, it’s nearly impossible for investors to compare and benchmark peer performance on this issue.

To improve communications between companies and investors SASB has developed a disclosure topic for the Meat, Poultry & Dairy industry: “percentage of animal production that receives (1) medically important antibiotics and (2) nontherapeutic antibiotics.”

Through improved disclosure companies and investors can work together to mitigate the global financial and health risks associated with the rise of antibiotic resistant bacteria.

Levi Stewart is SASB’s Consumption 1 sector analyst.