How SASB’s framework relates to the global sustainability disclosure ecosystem

The growth of international investor interest in the reporting of sustainability factors by corporations has been breathtaking. In 2015, over 80% of S&P 500 companies issued sustainability reports, compared to 20% just four years earlier. In 2016, nearly 70% of companies addressed at least three quarters of SASB disclosure topics in their SEC filings. Yet, investor dissatisfaction with the quality of sustainability information provided to them is high, with a lack of standards for such disclosure cited by 60% of investors as an impediment to integrating such factors in their investment decisions.

By developing industry-specific standards for the disclosure of ESG information to investors, SASB is working to address this investor dissatisfaction. SASB standards are designed for inclusion in mandatory financial reports. In the US, this takes the shape of the Form 10-K. U.S. securities law firmly undergirds SASB’s work and process, providing a solid foundation for the use of SASB standards by U.S. companies.

But SASB’s rooting in U.S. securities law has occasionally led to confusion about the applicability of SASB standards to multi-national companies and companies based outside the U.S. It is assumed by some that SASB’s standards are exclusively for American companies and American investors. In an age of global markets and global sustainability concerns, this couldn’t be further from the truth.

SASB’s approach to standard-setting is industry-based, not geography-based; many of the issues and disclosure topics identified as material by SASB’s process cut across borders. Carbon emissions and climate change care not about national sovereignty or man-made demarcations. Addressing the need for comparable data on how businesses manage sustainability issues across global markets while maintaining focus on issues that impact the financial or operating performance of international companies is a balance that SASB works hard to maintain.

To ensure that SASB standards are cost-effective for firms and decision-useful for investors, SASB’s research team has worked to accommodate, where possible, the nuance of various domestic and international specifications into industry-specific standards for 79 industries.

Examples abound. Within the Chemicals industry standard, the “Safety and Environmental Stewardship of Chemicals and Genetically Modified Organisms” disclosure topic relies upon “REACH,” a European (but internationally-applied) standard. Within the Automobiles industry standard, the “Fuel Economy and Use-phase Emissions” disclosure topic references several international norms (such as MPG, L/KM, GCO₂/KM, and KM/L). Protocol derived from a convention by the International Maritime Organization informs the technical protocol for the disclosure of “Ecological Impacts” – a disclosure topic in SASB’s Marine Transportation industry standard.

SASB’s incorporation of internationally-aligned metrics is designed to achieve consistent disclosure for companies in a given industry, an integral aspect of SASB’s mission to standardize sustainability disclosure.

There are, of course, instances where the concepts underpinning specific disclosure topics are inherently varied across regions. Issues such as diversity and nutrition often have a nationally or culturally-specific context. In these cases, SASB acknowledges this variation by citing international equivalents, as appropriate. An example is the “Nutritional Content” disclosure topic within the Restaurants industry, the accounting metric for which refers to the Dietary Guidelines for Americans or international equivalents. SASB recognises that the standards may need to be further refined to suit different markets in various contexts. This is an evolving process that we look forward to exploring and encouraging.

Finally, SASB’s engagement with various globally-oriented sustainability reporting bodies further supports the international application of SASB’s framework. Through working relationships with the Task Force on Climate-related Financial Disclosures, the Global Reporting Initiative, the International Integrated Reporting Committee, and Principles for Responsible Investment, SASB is working to ensure that its process and framework operate smoothly and logically alongside other key players in the sustainability reporting and disclosure ecosystem.

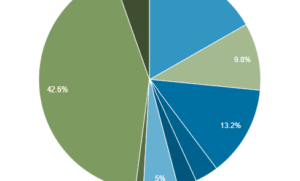

From the participation of non US-based investors in SASB’s Investor Advisory Group, to the 120+ countries from which SASB standards have beend ownloaded, it is clear that global interest in SASB’s framework and standards runs high.

SASB is firmly rooted in the legal and regulatory framework of the United States. But in a world of blurred borders where both capital and sustainability concerns flow freely, facilitating the international applicability of the standards is essential to assuring their efficacy.

Jill Richardson is SASB’s Digital Communications Manager.